What is a consolidated balance sheet?

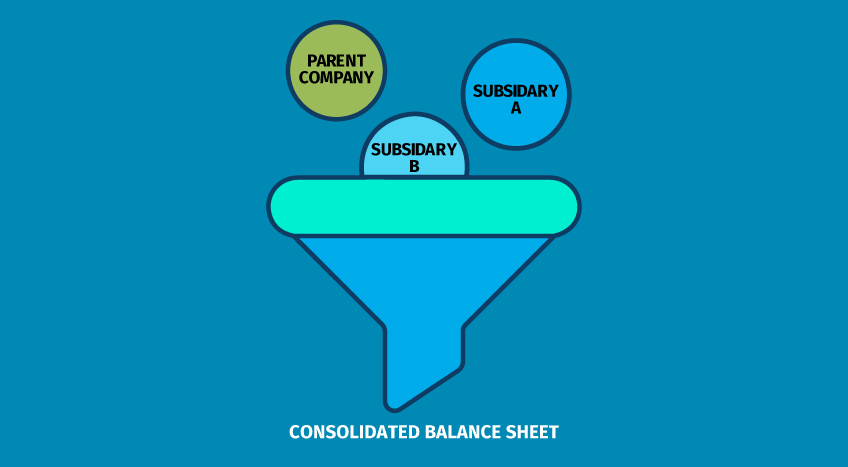

A consolidated balance sheet is a financial statement that shows the financial position of a parent company and its subsidiary companies. In simple words, a consolidated balance sheet is mere consolidation of financial details of all a subsidiary including parent company and presenting as one balance sheet for the entire group.

A consolidated balance sheet is usually prepared by the business operating as a group of companies that have more than one subsidiary and it portrays the combined details of assets and liabilities.

Format and example of consolidated balance sheet.

P Ltd acquired Q Ltd on 1.1.2018. Their balance sheet as at 31.3.2017 is given below. Using this, let us prepare a consolidated balance sheet.

P Ltd Balance Sheets as at

31st March 2017

Liabilities | P Ltd ( INR ) | Assets | P Ltd ( INR ) |

Share Capital : 10,000 Equity shares of Rs 10/- each fully paid 5,000 Equity shares of Rs 10/- each fully paid |

1,00,000

- | Fixed Assets Investments : 4,000 Shares in Q Ltd | 80,000

40,000 |

General reserve | 40,000 | Stock | 20,000 |

Profit and Loss Account | 20,000 | Debtors | 25,000 |

Creditors | 10,000 | Cash and Bank | 5,000 |

| 1,70,000 |

| 1,70,000 |

Q Ltd Balance Sheets as at

31st March 2017

Liabilities | Q Ltd ( INR ) | Assets | Q Ltd ( INR ) |

Share Capital : 10,000 Equity shares of Rs. 10/- each fully paid 5,000 Equity shares of Rs. 10/- each fully paid |

-

50,000 | Fixed Assets Investments : - 4,000 Shares in Q Ltd | 45,000

- |

General reserve | 10,000 | Stock | 10,000 |

Profit and Loss Account | 10,000 | Debtors | 10,000 |

Creditors | 5,000 | Cash and Bank | 10,000 |

| 75,000 |

| 75,000 |

Consolidated Balance Sheet P Ltd and it is Subsidiary Q Ltd

As at 31.12.2017

How do businesses prepare consolidated balance Sheet?

A consolidated balance sheet is a key financial statement in case of group companies. The financial statements of different companies belonging to the same group are consolidated to present the financial position as a whole.

Manually preparing a consolidated balance sheet involves several steps right from arriving the share capital, profits etc. and it is a tedious task. As a result, businesses have automated the task of consolidating financial information using accounting software. Thereby, consolidated balance sheet is readily available as an when required. Not just consolidated balance sheet but also several other key financial and accounting reports can be consolidated a click of a button.

Using Tally.ERP 9, you can consolidate the entire books of accounts, view consolidated reports and seamlessly compare the parent and subsidiary companies report.

In Tally.ERP 9, you can do this by creating a group company. It allows you to conveniently view all your companies in one place.

Group company creation in Tally.ERP 9

Group company function as a single economic entity, where financial reports such as balance sheet, profit and loss a/c and trial balance are consolidated without any impact on the transactions and real-time basis.

Using the group company, you can compare the performance of your subsidiary companies and keep a tab on the overall business.

Comments

Post a Comment