A brief about Current Assets

Just like we buy things which will be useful and with the belief that some benefit can be derived from it, businesses too have such things which are called as ‘Assets’.

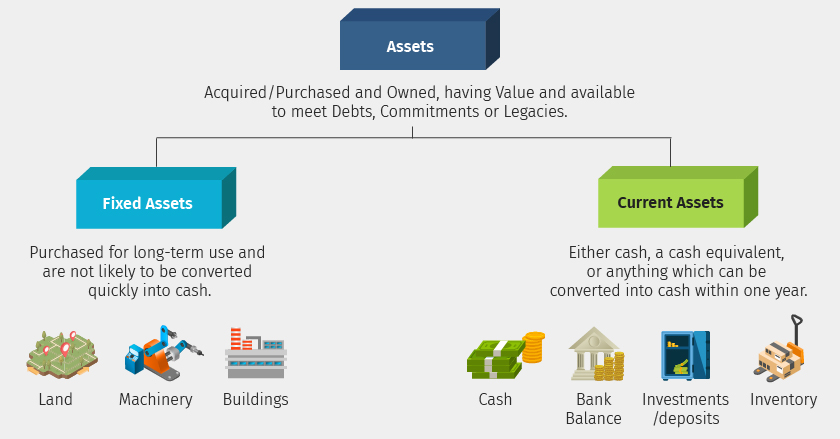

Assets in a business can be defined as something which is purchased and owned, having value and available meet debts, commitments or legacies.

In other words, assets simply refer to useful and valuable things which a business buy. Off course, with the belief that a business derives benefits from it and to meet the business commitments.

You brought a laptop to help you with studies. It’s an asset to you. The money you have is also an asset, because, it helps you to meet the future commitments of studies. When you apply this to businesses, many such things are required to run the business smoothly.

Assets in a business can be anything ranging from something as buying a building to unsold goods. Some of them are highly liquid in nature and few assets take longer time. Basis of this nature, the assets can be classified into “Fixed Assets’ and ‘Current Assets’.

Definition of Current Assets

Current assets can be defined as an asset which is either cash or cash equivalent or anything which can be converted into cash quickly, usually 1 year. Because of its liquidity nature, the current assets play an important role in funding day-to-day business operations. It’s a key indicator of business liquidity.

Think like this, just having a laptop isn’t enough to complete the studies. You need to meet several other commitments related to studies. For you to meet those, you need cash. Here Laptop is a fixed asset and cash is the current asset.

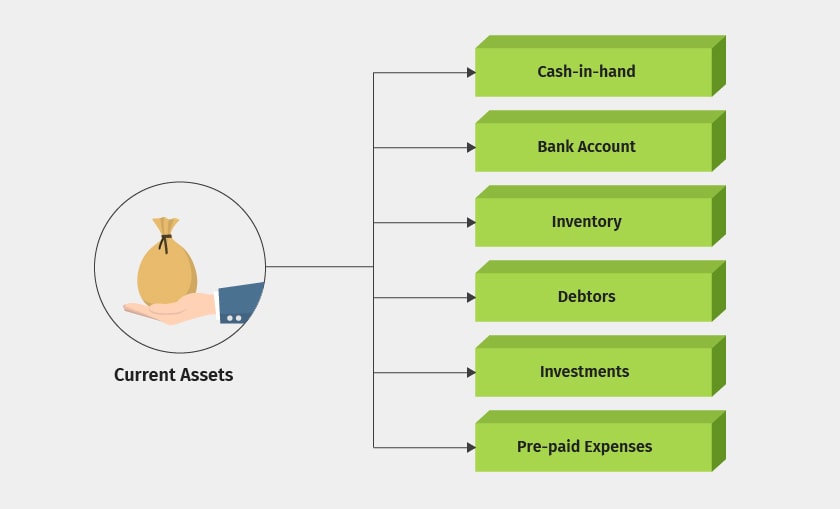

Having understood the definition of current assets, let’s take a look at different types of current assets in the next section.

Types of Current Assets

The above are some of the most common types of current assets you can find in the balance sheet.

Examples of Current Assets

The examples in the following table will help you identify the current assets.

| Examples | Is it a Current Asset? | Reason |

| Sold to Rakesh Enterprises for 35,000 on credit | Yes | Rakesh Enterprises is a debtor |

| On 31st March,2019, Max hardware has a closing stock worth 23 lakhs | Yes | Stock-in-hand can be quickly liquated by way of sales |

| Purchased furniture for office use | No | The usage is for the long-term and not likely to be converted into cash quickly. It is a fixed asset |

| Max Hardware has a bank balance of 15 Lakhs | Yes | Cash or cash equivalent is considered as a current asset |

| Advance rent paid | Yes | Any pre-paid expenses as on the balance sheet are current assets |

| Purchased Computer for office use | NO | It’s a fixed asset. |

Similar to current assets, the liability side of the balance sheet consists of current liability. You should know these before preparing or reading the balance sheet.

Comments

Post a Comment