Introduction to Current Liabilities

Before understanding the current liabilities, let’s talk a bit about liabilities in general and what does it mean to a business. Liabilities are the obligations or Debts payable by the business in future in the form of money or goods.

To simplify, it is the amount of money that a business must pay in future. It could be anything right from paying back to its investors to as small as money which is yet to be paid for courier delivery partner. No matter how big or small, anything which a business owes to others is considered as liabilities.

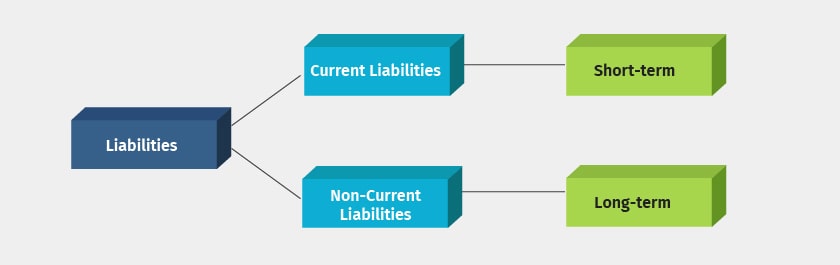

While this is true but based on the nature of liabilities, some of them need to be paid in a shorter time and while some will stay for long time as liabilities. Basis this nature, the liabilities can be classified as ‘Current Liabilities’ and ‘Non-current Liabilities’.

Definition of Current Liabilities

Current liabilities are the short-term debts or obligation which a company needs to pay within a year. salaries due to be paid, amount payable to suppliers, etc. are some of the examples of current liabilities.

Current liabilities are one of the major areas of the cash outflow for any business and it should be managed efficiently to keep your cash flow in control.

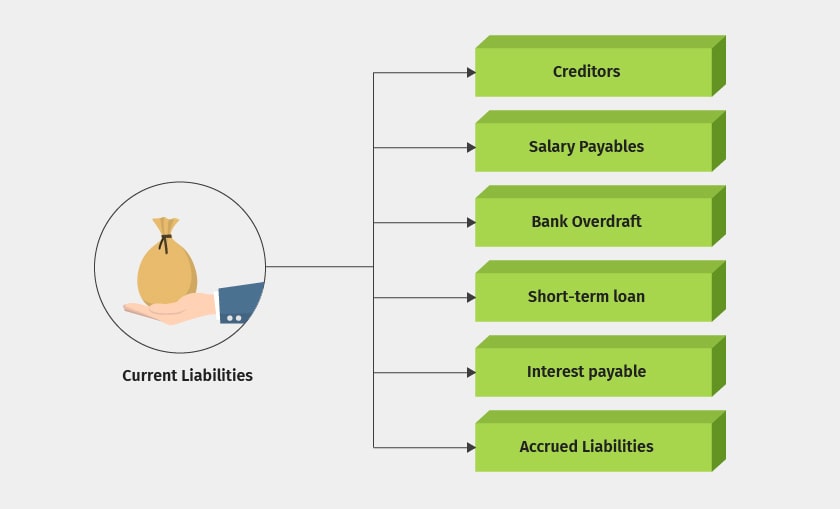

Examples of Current Liabilities

The following are the examples of current liabilities which needs to be paid in short-term, usually within 1 year.

Comments

Post a Comment