Since time individuals began buying and selling goods to one another, there has been a need to document ownership of the goods as it changed hands. In order to prove ownership, the bill of sale was developed to confirm that a seller did indeed transfer ownership of their goods to the buyer.

What is Bill of Sale?

A bill of sale is a legal document that serves as proof of sale and purchase transaction. It is a document that records the transfer of ownership from one person to another which signifies that the goods have been sold to another person.

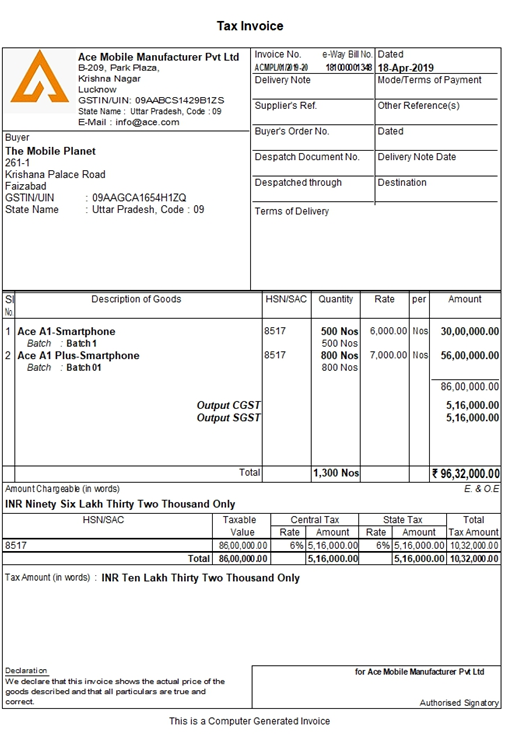

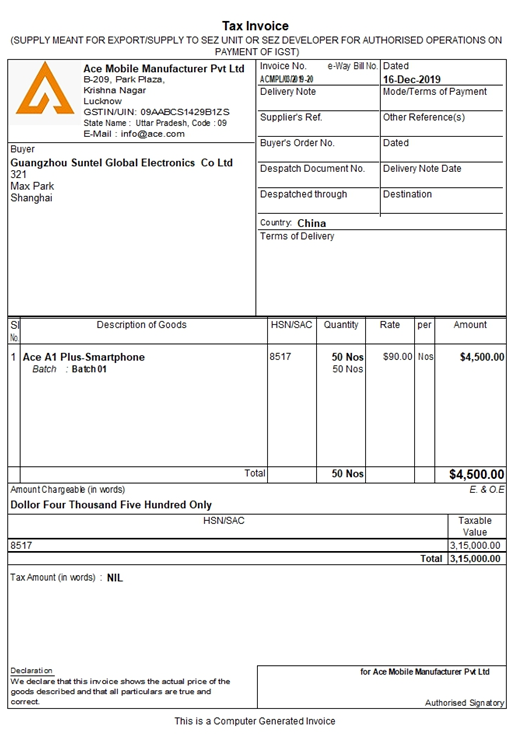

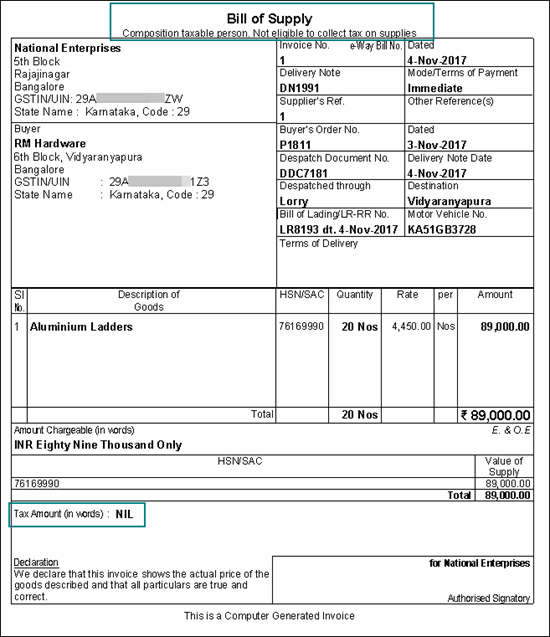

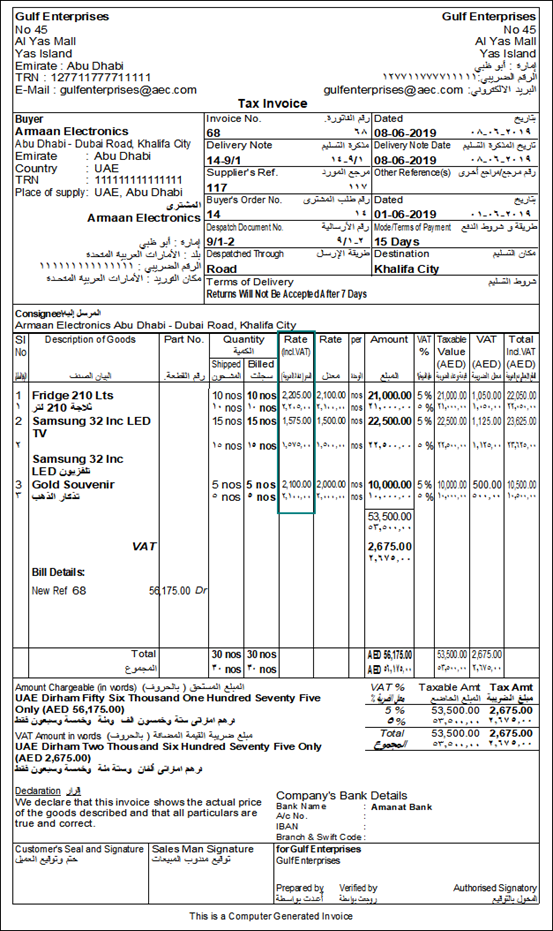

It is used for transactions which involve a transfer of ownership of movable and tangible goods. Tax Invoice, Bill of Supply, Invoice, Bill etc. are some of the common names of a bill of sale.

Details of Bill of Sale

Generally, a bill of sale includes the following information:

- Date of purchase

- Name and address of the seller and of buyer

- Amount paid for the transfer of ownership

- Description of the assets being transferred

- Guarantee that the item is free from all claims and offsets

- Representations or warranties

- Signatures of the seller, of the buyer, and of a notary public

Who Issues the Bill of Sale?

It is the seller that typically produces the document and both the parties involved in the transaction can gain protection from the document. The bill of sale can be used for tax reporting, accounting and insurance purposes.

Why do you need Bill of Sale?

- Proof of transfer of ownership

The bill of sale is frequently used to transfer the title to ownership of items and in all those transactions which required the proof of the transfer of goods. a bill of sale act as proof.

Because of this, the bill of sale serves as a legal contract between the buyer and the seller and is recognized as such by the courts as long as it conforms to the specific state requirements in which it was enacted.

- Acts as a record of sale

Let’s say you are selling your boat to a prospective buyer. The most important document for you, as a seller, would be the bill of sale because it will have the information of the buyer, date when the boat was sold, amount, etc. which confirms that you have sold the boat to a particular person.

A Bill of Sale can be used as a proof to signify a sale. Let’s say that when you go for shopping in a big departmental store and you buy groceries, the retailer gives you a slip or a bill which will have details of all the items that you bought along with their price.

- Details specific requirements or customization for any situation

A bill of sale can be tailor-made to suit the requirements of either the buyer or the seller depending on whether there are any warranties being offered on the goods being sold or if there are specific stipulations that must be met in order to complete the transaction.

With the featurettes of customization, a bill of sale proves to be an important legal tool that is utilized when it is necessary to document the transfer of ownership of goods or property from the seller to the buyer.

- Legal Requirements

In most of the countries, a bill of sale is mandatory to be issued when goods are sold. The countries which have an indirect tax system such as VAT, GST etc., are enacted with the provision which prescribes the guidelines to issue a bill of sale. GST in India, UAE VAT, Saudi Arabia VAT etc. are some of the indirect tax laws which clearly issues the timeliness and manner in which the bill of sales should be issued. Bill of sale is most popularly referred to as Tax invoice.

Format and Examples of Bill of Supply

Export Invoice in India with Foreign Currency using Tally.ERP 9

Bill of Supply Format in India using Tally.ERP 9

Bilingual Invoice in UAE VAT generated using Tally.ERP 9

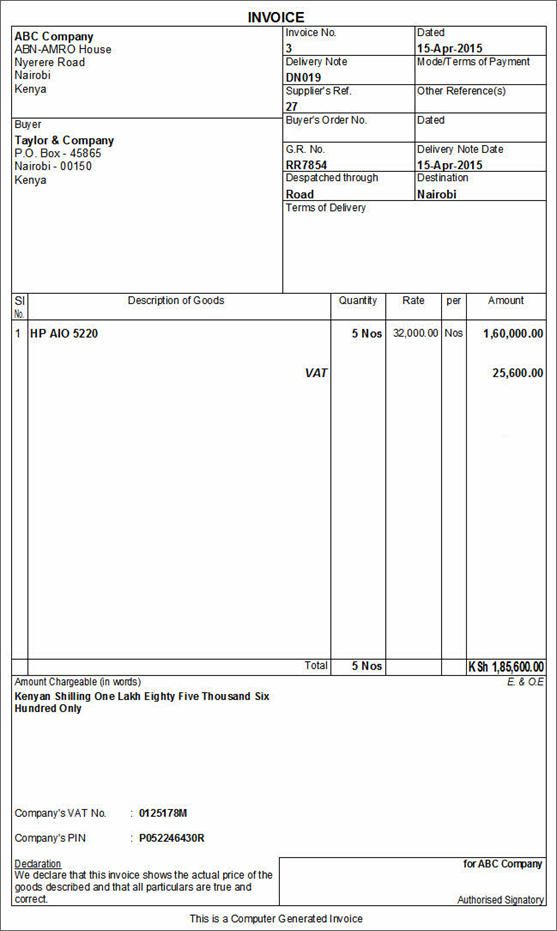

VAT Invoice in Kenya generated in Tally.ERP 9

Comments

Post a Comment