What is Cash Deposit Slip?

A cash deposit slip is a record of how much money will be/has been deposited into a bank account. In simple words, a cash deposit slip is a form that is used to itemize the cheques and cash being deposited into a bank account.

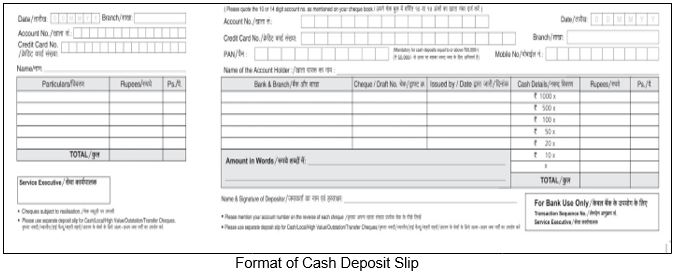

Components and Format of Cash Deposit Slip

The cash deposit form contains the following information:

- The name on the account

- The account number

- The amount or value of each cheque being deposited

- The amount or value of any bills and coins being deposited

How to use Cash Deposit Slip?

One can deposit money into the bank either by cash or cheque. Below is a step-by-step process to use the cash deposit slip.

Step 1 | Ask for a deposit slip and fill up all the details, like date, account, type, account number, account holder name, amount and finally sign on the deposit slip. |

Step 2 | Remember to fill all the details in the receipt attached to the deposit slip. |

Step 3 | If the deposit is by cash then enter the denominations in the denomination column. |

Step 4 | If the deposit is by cheque, then enter the bank details like the name of the bank, cheque number, date etc., |

Step 5 | Turn over the deposit slip and the cash or the cheque to the concerned person in the bank. |

Step 6 | Remember to collect the receipt (also called as counterfoil ). |

Cash Deposit Slip Process

The completed cash deposit slip is bundled with the checks, bills and coins itemized on the form and presented to the cashier at the bank. The cashier or the concerned bank person processes the deposit and matches the total processed to the total stated on the deposit slip to ensure that they match; thus, the cash deposit slip is a cash processing control for the bank.

Once the cashier processes the deposit, he gives the customer a receipt, which states the total amount of the deposit, along with the date and time. The receipt given by cashier to the depositor also called a counterfoil act as proof that the deposit was made.

Cash Deposit in Excess of Rs 50,000/

While depositing cash in excess of Rs. 50,000/-, remember to carry a PAN (Permanent Account Number) card. It’s Mandatory to mention the PAN for deposits over Rs. 50,000/-

Benefits of Cash Deposit Slips

Cash deposit slips offer protection to both the bank and the customer. Banks use them to maintain a written ledger of funds deposited throughout the day and to ensure that no deposits are unaccounted at the end of the business day.

For the person depositing cash, a cash deposit slip serves as a de facto receipt that the bank properly accounted for the funds and deposited the correct amount and into the correct account. If the depositor later checks the account balance and discovers the deposit was not counted correctly, the deposit slip serves as proof that the bank acknowledged receiving the funds from the customer.

Changing Phases and Usage of Cash Deposit Slip

Cash deposit slips are becoming a thing of the past as banks have begun removing deposit slips from their branches in favor of new technology. Banks today do not require deposits slips for ATM deposits since the computer can read the cheque or count the cash and electronically credit the account associated with the ATM card.

On the other side, the accounting software used by the business has become smart to support all banking needs. The accounting software enables the businesses to generate the cash deposit slip right from the software. Thus, making it possible to save time involved in manually writing the cash deposit slip and more importantly, preventing errors. We all know how bad the error in the cash deposit slip hurts.

Using Tally.ERP 9, you can auto-generate cash deposit slip for depositing cash into a bank on any date. The cash deposit slip provided in Tally.ERP 9 has all the contents of cash deposit slip such as Account Number, Account Holder Name, Bank Name, Branch Name, cash denomination etc. and all these details are captured automatically into the slip so that user need not enter all the details manually.

Sounds interesting? Read more on cash deposit slip and other banking utilities supported in Tally.ERP 9.

Comments

Post a Comment