Introduction to Cash Discount

What comes to mind when we hear the word ‘DISCOUNTS’? It’s all about the reduction in selling price. While this looks obvious, a business does offer a kind of discount which is not at the time of selling but at a later stage.

This sounds little different, isn’t it? Why? We all have personally experienced a discount which is an upfront reduction in selling price. While the business does offer such type of discount (upfront reduction in selling price), there is another type which is popularly known as ‘Cash Discount’.

Generally, business practises 2 types of discount as shown in the below image.

In this article, we will understand the Cash discount and how to calculate it.

What is Cash Discount?

Every trader is pleased when they see that their customers have paid the invoices made out to them. And to grant an incentive for this, many service providers and distributors offer a price reduction in the amount of a certain percentage of the invoice total. This price reduction is called a cash discount.

In simple words, a cash discount can be termed as an incentive that a seller offers to a buyer in return for paying a bill owed before the scheduled due date.

Terms of Cash Discounts

Cash discounts also called as ‘early payment discount’ or ‘prompt payment discount’. Although we have defined cash discount above, understanding the concept still involves understanding the related terms. Here are three terms you should know:

Period of discount - | The time a customer is given to pay the invoice and receive the discount before the deadline. |

Percentage discount - | The percentage amount that can be deducted from the total invoice amount. |

Amount of cash discount - | The price reduction that results once the discount percentage has been applied. |

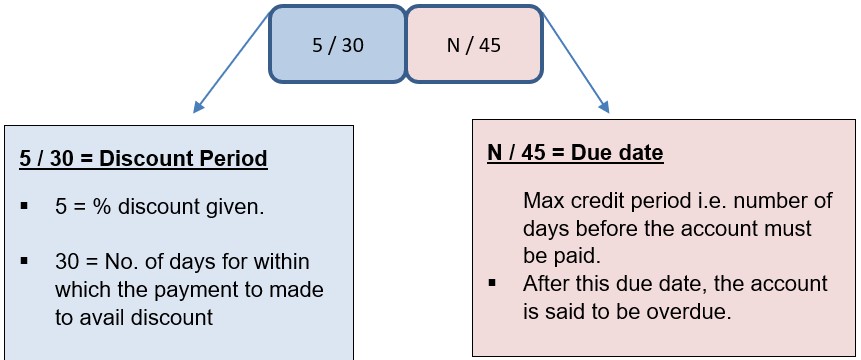

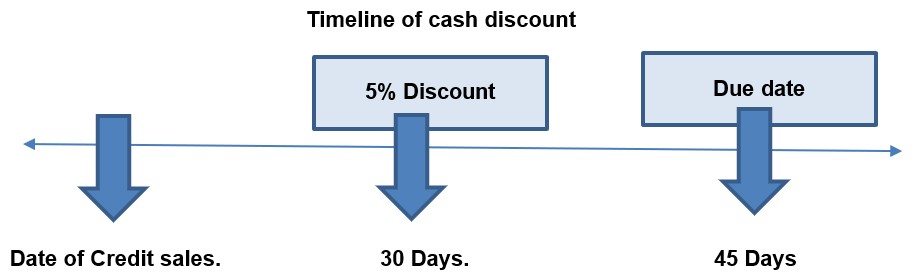

The cash discount is generally written in the following manner:

5/30, N/45

This is not a location coordinates. This is the way cash discount terms are written. Let’s understand this:

Cash Discount – Advantages and Disadvantages

Advantages of cash discount

- Encourage debtors to pay on time

- Reduces the chances for the occurrence of bad debts

- Helps in running of trade cycle as cash will be available earlier due to reduced length of time

- Cash discounts may increase sales as new customers will be entertained with the cash discount part that the firm offers.

Disadvantages of cash discount

- Results in reduced cash inflows from debtors as cash discounts are offered.

- Net profits are affected as discount expenses are charged to profits.

Cash Discount Methods and Examples

Ordinary dating method

A credit term of [ 2/10, n/30] means that you will get a discount of 2% if you clear your account within 10 days. In other words, if you make the payment within 10 days from the date of the invoice, you will be eligible for a 2% discount. It also means that you must pay the bill within 30 days to avoid interest charges.

Let’s understand this with an example

Mr Rahul received an invoice for Rs. 3,000 /- dated 22 November 2019 with terms [ 2/10, n/30]. He paid the whole amount on 30 November 2019. How much did Mr Rahul effectively paid for the bill?

- Date of Invoice: 22nd November 2019

- Day 1 of the cash discount period. : 23rd November 2019

- Last day of the Cash discount period: 31st November 2019

- Date of payment: 30th November 2019

Cash discount. = Price x Discount rate

= Rs. 3,000 x 2/100

= Rs. 60

Amount effectively paid by Mr Rahul. = Bill value (- ) Cash discount

= Rs. 3,000 (- ) Rs. 60

= Rs. 2,940 /-

End of the month method [ E.O.M ]

A credit term of [ 2/10,n/30 E.O.M ] means that you will get a discount of 2% if you pay your account within the first 10 days of next month. In other words, if you make the payment within the first 10 days of next month from the date of the invoice, you will be eligible for a cash discount. It also means that you must pay the bill within the first 30 days of next month to avoid interest charges.

Let’s understand this with an example

Mr Amit received an invoice for Rs. 3,000 /- dated 05th November 2019 with terms [ 2/10, E.O.M ]. He paid the whole amount on 10th December 2019. How much did Mr Amit effectively paid for the bill?

- Date of Invoice: 05th November 2019

- Day 1 of the cash discount period: 01st December 2019

- Last day of the Cash discount period: 10th December 2019

- Date of payment. : 10th December 2019

Cash discount = Price x Discount rate

= Rs.3,000 x 2 / 100

= Rs. 60

Amount effectively paid by Mr Amit = Bill value (-) Cash discount

= Rs. 3,000 (-) Rs. 60

= Rs. 2,940/-

Receipt of goods dating method [ R.O.M ]

A credit term of [ 2/10 R.O.M] means that you will get a discount of 2% if you make the payment within the first 10 days after the goods are received.

Let’s understand this with an example

Mr Jagdish received an invoice for Rs. 3,000 /- dated 10th November 2019 with terms [ 2/10, n/30 R.O.G] for a shipment that arrived on 5th of December 2019. Mr Jagdish paid for the bill in full on the 10th of December 2019. How much did Mr Jagdish effectively paid for the bill?

- Date of Invoice: 10th November 2019

- Day 1 of the cash discount period: 06th December 2019

- Last day of the Cash discount period: 14th December 2019

- Date of payment: 10th December 2019

Cash discount = Price x Discount rate

= Rs. 3,000 x 2 / 100

= Rs. 60

Amount effectively paid by Mr Jagdish = Bill value ( - ) Cash discount

= Rs. 3,000 ( - ) Rs. 60

= Rs. 2,940 /-

Now we have understood the cash discount and methods to calculate it, the next big question as a business owner you must answer is should you avail the cash discount? it’s obvious that opting discount looks beneficial as you are going to pay lesser but owing to certain factors, it is not beneficial always.

To answer this question, you need to calculate the cost of not taking the discount. Basically, you need to check the opportunity cost or implied cost of not availing the discount vis-a-vis the return on investment or cost of credit. Find out why it is not beneficial and how to calculate the opportunity cost by reading our article ‘Cost of Accounts Payable’

Comments

Post a Comment