What is MIS?

MIS Reports are reports required by the management to assess the performance of the organization and allow for faster decision-making. A Management Information System, often simply referred to as MIS, can be understood by looking at each of the words that make up the name. There is the management, the information, and the system. At the heart of it, such a system is one that will provide important information to the management of the company.

The complexities of running businesses, have made us more reliant on advanced technologies which will remove any room for errors. On one hand, it accurately states what a management information system does for the management of the company. On the other hand, it cannot be overemphasized that management information systems are very important to the smooth running of a business. It is crucial that businesses opt for an automated management information system is set up for better decision-making.

What is the need for MIS?

The following are some of the justifications for having an MIS system

- Decision makers need information to make effective decisions. Management Information Systems (MIS) make this possible.

- MIS systems facilitate communication within and outside the organization – employees within the organization are able to easily access the required information for the day to day operations. Facilitates such as Short Message Service (SMS) & Email make it possible to communicate with customers and suppliers from within the MIS system that an organization is using.

- Record keeping – management information systems record all business transactions of an organization and provide a reference point for the transactions.

Components of MIS

The major components of a typical management information system are;

- People – people who use the information system

- Data – the data that the information system records

- Business Procedures – procedures put in place on how to record, store and analyze data

- Hardware – these include servers, workstations, networking equipment, printers, etc.

- Software – these are programs used to handle the data. These include programs such as spreadsheet programs, database software, etc.

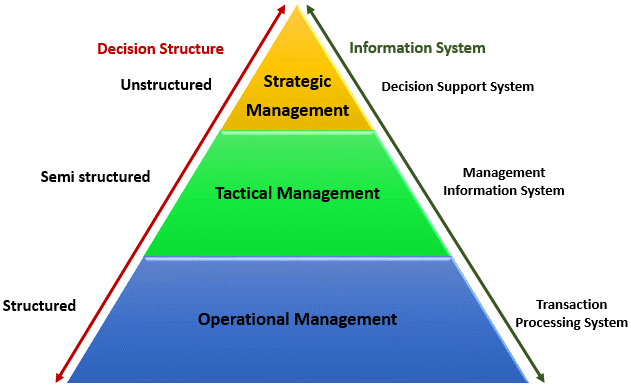

Types of information system

Management information systems find their way into just about every aspect of a company. They work with the people in the company, the technology in the company, its products, and the inter-relationships between all of these on a day-to-day basis. If you implement an MIS in your company, then the levels of efficiency you could potentially achieve with it are mind boggling.

Types of MIS reports in Tally.ERP 9

· Accounting reports

To obtain information on the financial position, operational performance and economic activities of the business.

· Financial reports

To determine the financial condition of an organisation as required by shareholders, creditors and government units.

· Inventory reports

To manage the Inventory effectively since the actual status of stock items is obtained.

· Management control reports

To utilise budgets, cost centre reports, scenario reports etc. for controlling activities.

Wish to make your business more efficient and processes more streamlined? Give Tally.ERP 9 a shot and we promise you will not be disappointed.

Comments

Post a Comment