What is Profit & Loss A/C

Profit and Loss Account is a type of financial statement which reflects the outcome of business activities during an accounting period (i.e. Profit or loss). Reported income and expenses are directly related to an organization’s are considered to measure the performance in terms of profit & loss.

Objective of Profit & Loss A/c

The very purpose of profit and loss account is to ascertain whether the business is making profit or loss for a given period. In other words, Profit & Loss Account reveals money spent or cost incurred in an organization’s effort to generate revenue, representing the cost of doing business.

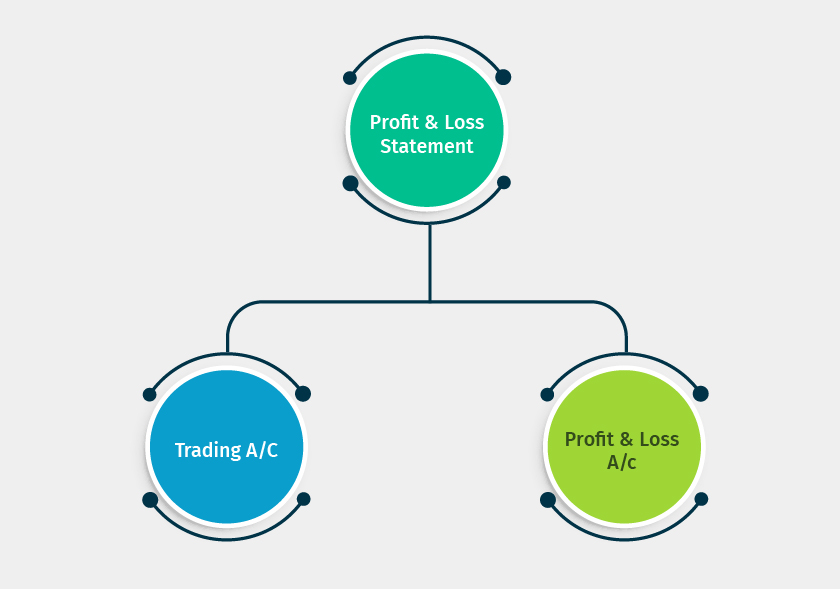

Components of Profit & Loss A/C

Profit & Loss Account consists of two broad components mentioned below

- Trading Account

- Profit and loss account statement.

Trading Account

Trading Account is an account which is prepared by a manufacturing/merchandising concern. The purpose of trading account or this financial statement is to find out the gross profit or gross loss which, is an important indicator of business efficiency. All the expenses and income which are direct in nature are considered.

The components which forms part of the trading account:

| Debit side of Trading Account | |

| Items | Description |

| Opening Stock | This includes the closing balance inventory carried forwarded from previous period. In the case of trading concern, the opening stock includes only finished goods. The amount of opening stock should be taken from Trial Balance. |

| Purchases | The amount of purchases made during the year. Purchases include cash as well as a credit purchase. The deductions can be made from purchases related to purchase return, goods withdrawn by the proprietor, goods distributed as free sample etc. |

| Direct Expenses | It means all those expenses which are incurred from the time of purchases to making the goods in a suitable condition. These expenses include freight inward, packaging cost, wages etc. |

| Gross Profit | If the credit side of trading A/c is greater than the debit side of trading A/c, gross profit will arise. |

| Credit side of Trading Account | |

| Items | Description |

| Sales Revenue | It denotes income earned from the main business activity or activities. The income is earned when goods or services are sold to customers. If there is any return, it should be deducted from the sales value. |

| Closing Stock | This includes all the value of inventory held on the date of closure of books of accounts.In case of trading business, there will be closing stocks of finished goods only. According to conservatism convention, stock is valued at cost or net realizable value whichever is lower. |

| Gross Loss | If the debit side of trading A/c is greater than the credit side of trading A/c, gross loss will appear. |

Profit and Loss A/c Statement

This component considers all the indirect expenses and incomes including the gross profit/loss to arrive the net profit or loss.

| Debit side of Profit and Loss Account | |

| Items | Description |

| Cost of Sales | This term refers to the cost of goods sold. The goods could be manufactured and sold. |

| Other Expenses | All expenses which are not directly related to the main business activity will be reflected in the P & L component. The expenses covered here are mostly related to administrative, selling and distribution expenses. Examples are salary to office staff, salesmen commission, insurance, legal charges, audit fees, advertising, free samples, bad debts etc. It will also include items like loss on sale of fixed assets, interest & provisions and accrued expenses as well. |

| Abnormal losses | All abnormal losses are charged against Profit & Loss Account. It includes stock destroyed by fire, goods lost in transit etc. |

| Credit side of Profit and Loss Account | |

| Items | Description |

| Revenue Incomes | These incomes arise in the ordinary course of business, which includes commission received, discount received etc. |

| Other Income | The business will generate incomes other than from its main activity. These are purely incidental. It includes items like interest received, dividend received, etc,. |

Comments

Post a Comment